Several investors in The Bedrock Fund have asked how we fared during this year’s very active hurricane season. This is a relevant question considering we have a number of borrowers in Florida and across the Southeast. At any given time over the past 5.5 years, 10-20% of our loan portfolio has been located in the state of Florida. Fortunately, those loans are scattered throughout the state, so exposure to any one storm is typically limited.

Looking at the two recent hurricanes, we had a number of loans in the paths of these storms. Of those loans, six experienced minor cosmetic damage and two suffered moderate to significant damage. We are working with those borrowers to assist as we can to get those properties cleaned up and on the market as quickly as possible. As a matter of fact, as of this writing, over half of those are back on the market with full repairs. We expect these loans to be paid off on time with no interruption in monthly interest payments.

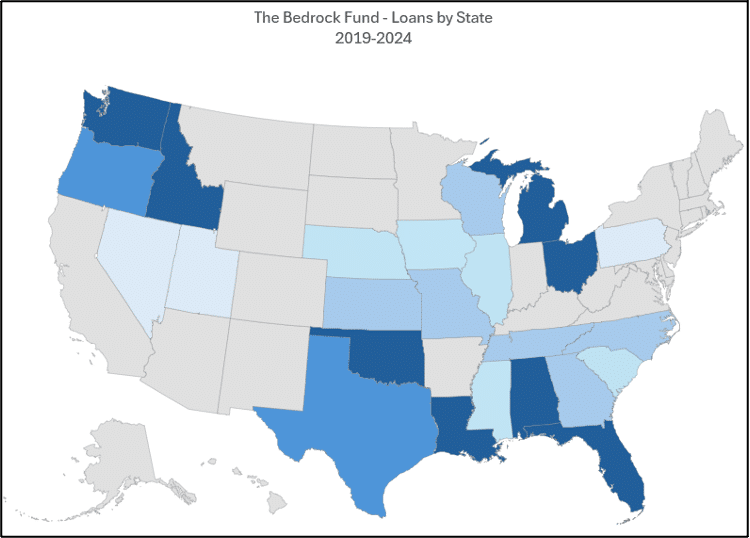

The Bedrock Fund’s Geographic Footprint

Since 2019, the Fund’s geographic footprint has grown threefold from 8 states to 24 states. In 2024, we picked up great new borrowers in Illinois, Kansas, South Carolina, Nebraska, and Utah. As we look to 2025, we plan to continue attracting new borrowers in new states while we continue to spread risk across a larger geographic area. It seems prudent, due to this year’s hurricane activity, to look toward a reduction of exposure in the most hurricane prone areas, such as certain parts of Florida, Louisiana, and Texas. We will continue to service all of our existing borrowers in those markets, but we will look to limit growth of new borrowers in hurricane prone areas. As always, our main focus is adding and keeping the most highly performing borrowers of the HomeVestors of America system in states with favorable lending regulations. So far our results have been stellar. We have not experienced a single default or even a 30-day late payment in almost 6 years of operation. We intend to make every effort to keep it that way.

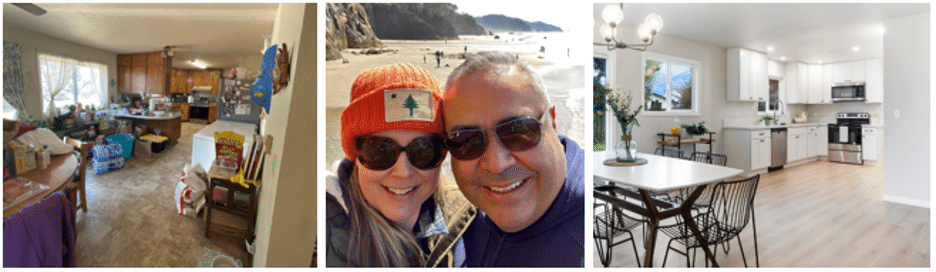

Borrower Spotlight

SFC Properties has proven to be an exceptional borrower in Portland, Oregon. The investment firm is run by Ron and Melissa Negreros. They have been in the industry for more than 10 years, have been operating their HomeVestors franchise in Oregon since 2019 and have flipped over 50 homes in that time. They are now working on building their rental portfolio. Ron and Melissa originally hail from Southern California and Arizona respectively but have fully embraced the natural beauty of the Pacific Northwest where they enjoy hiking, camping, gardening, and exploring the Oregon coast. We are fortunate to have such good customers and experienced investors like Ron and Melissa within our network.

Real Estate Market Update

Housing inventory continues to be highly constricted in the United States. There are numerous stories regarding stagnant inventory and fire sales in Florida and Texas. Those trends are not supported in the data we follow. Actually, Florida has less inventory this week than in previous months and prices have remained steady. High interest rates definitely had an impact on the market with reduced home sales over the past year. There are now seven states in the country that have inventories back to normal 2019 levels including Arizona and Colorado. With rates recently holding around 6.5%, we will be watching to see if these trends continue.

According to Altos Research’s most recent podcast, the last three weeks have seen more homes sales than either of the past two years. So even though sales are not robust, they have increased as rates have dropped, as we would expect. There seems to be support in the data that when rates are below 6.5%, and certainly closer to 6%, there is more movement in the market. Prices have remained steady overall this year. If rates continue to be volatile as they have been recently, we could be in a holding pattern until next spring with inventory gains and sales gains both remaining flat.

For more information about the housing market and more statistical information, please follow Altos Research on YouTube. We find it to be a thorough, real time and objective source of real estate data and trends. The Bedrock Fund is not associated with Altos Research in any way, other than being a big fan.