The Bedrock Fund (Bedrock) has been doing asset-based real estate lending since 2019. Bedrock provides a “white glove” VIP lending service to some of the most experienced, high-volume real estate investment companies in the country. Our customers are part of the HomeVestors of America (HVA) Investor Network (We Buy Ugly Houses). HVA is a franchise organization boasting close to 1,200 franchisees that are all systematically trained to buy, rehab, and sell houses. This continuity in training gives the investors in Bedrock comfort in knowing that their capital is being used for making high-quality loans to experienced borrowers, not newbies in real estate investing, which keeps the risk profile of your investment at a very low level.

BEDROCK FUND PERFORMANCE

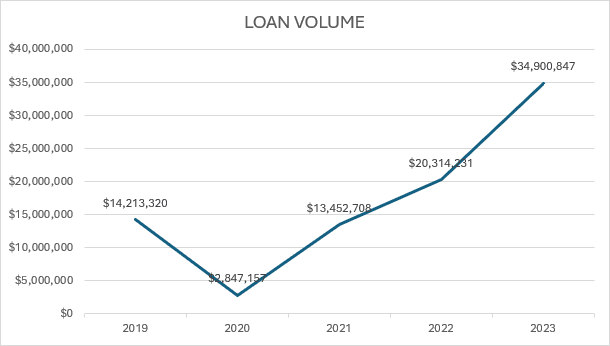

The Bedrock Fund Loan Volume Growth

The Bedrock Fund 3-year growth in loan volume:

2021 – $13,452,708

2022 – $20,314,231

2023 – $34,900,847

Increasing capital drives the growth of a boutique lending business like The Bedrock Fund. Fortunately, our capital stack continues to grow at a measured pace and so does our loan volume.

As you can see, our loan volume from 2021 to 2023 has increased over 250%. In some business types, that type of growth would come at a price of increased risk. That is not true for The Bedrock Fund because of our hand-picked VIP borrowers. As the capital of the company grows, the experience level of its borrowers remains the same. This keeps our risk level very low.

To that end, since its inception in 2019, The Bedrock Fund has never had a 30-day late payment or default of any kind. That kind of tract record is practically unheard of in the asset based lending space.

Loan Size is also Growing

The strategy of working with very experienced investors has paid off. The strategy has provided a nice uptick in the value of the loans the fund was able to make in 2023. We picked up some real superstars in a few of the higher-value markets

around the country including Florida, Colorado, Oregon, and Washington in addition to our bread-and-butter markets in the Southeast and Midwest. Here is a summary of the growth in loan value over the past three years:

2021 – $101,901

2022 – $142,057

2023 – $190,715

Borrower Spotlight

As we continue to grow, we continue to invite the best and the brightest borrowers to utilize our lending business to help grow their purchasing power. To that end, we’d like to congratulate one of our borrowers, Carl Bassett at Black Rock Real Estate for winning the top homebuyer award (Franchise of the Year) at the HomeVestors National Convention in Orlando, Florida in December 2023. Carl has been a constant competitor for this award over the past five years.

He and his team have bought and closed on 988 houses since becoming a franchisee in the HVA system. We are proud to have Carl as one of our most experienced borrowers!

“We love Bedrock because their loan process is simple and predictable. Unlike other hard money lenders, they are clear in their expectations and do what they say they’re gonna do. No last-minute surprises!” – Carl Bassett