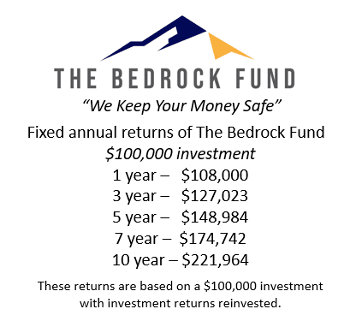

The Bedrock Fund is typically promoted as a safe, one-year investment that pays a fixed rate of return of 8%. Did you know however, that when investing in The Bedrock Fund, by not taking monthly interest payments and allowing your investment to compound, your returns are boosted significantly? For example, if you invested $100,000 and allowed compounding interest, your investment would be worth $127,023 in 3 years equal to an annual 9% return overall, and a five-year investment would generate an average annual return of almost 10% at $148,984. In essence you would earn a return higher than the stock market traditionally has provided, with far less risk. Here’s a table showing additional investment term returns:

Current Real Estate Market Conditions

Some of our investors have read the reports about potential falling home prices in Florida and Texas, which has brought up the question: how does The Bedrock Fund keep my money safe in a potentially declining market? First, let’s look at the reality of today’s real estate market without the media hype. We keep a pulse on the real estate market by reading updates from various proven real estate research companies and economists. None is better than the weekly analyses provided at Altos Research.com. If you are interested, you should listen to some of their free podcasts on YouTube. They have been spot-on through all of the changing conditions since Covid.

Here is a link to their most recent summary of market conditions:

“What to expect in the real estate market for the rest of the year” Altos Research

A few recent takeaways from our research:

- Home prices will stay flat through the rest of the year unless the fed reduces rates.

- Some local markets like southwest Florida and several Texas markets might experience modest sales price declines but no major concerns of a significant drop.

- There are more homes for sale than in the past two years, but not back to pre-pandemic levels.

- There is still a shortage of homes for sale nationally than homebuyers, a shortage of about 5 million homes. That gap has been widening for many years and will take many years to overcome.

- The median home sale price as of May 2024 was $419,300, up 5.8% from one year ago and the highest median price NAR (National Association of Realtors) has ever recorded.

- The nation had a 3.7-month supply of housing inventory in May, per NAR, which is still historically low and is considered a “seller’s market”.

- If rates are cut in Sept, as most Wall Street traders expect, it will drive more home sales and higher prices overall and reverse most of the slowdown in markets throughout FL and TX.

Prior to making loans to real estate investors who plans to buy, renovate and sell a home, we at The Bedrock Fund keep a forward-looking approach to each loan. We don’t look at how that city or zip code is performing today- we look at where it will be in 6 to 12 months. If we anticipate a zip code (and yes, we look all the way down to the zip code level) will be slowing or prices dropping, we will be more conservative with those loans, and coach our borrowers to be more careful with purchase prices and rehabs. This strategy has allowed us to maintain our record of no late pays and no foreclosures since we began in 2019. Additionally, we focus on making loans that are at or below the median prices in the zip codes of the houses in question. Houses at or below the median prices are much less susceptible to price swings than those above the median.

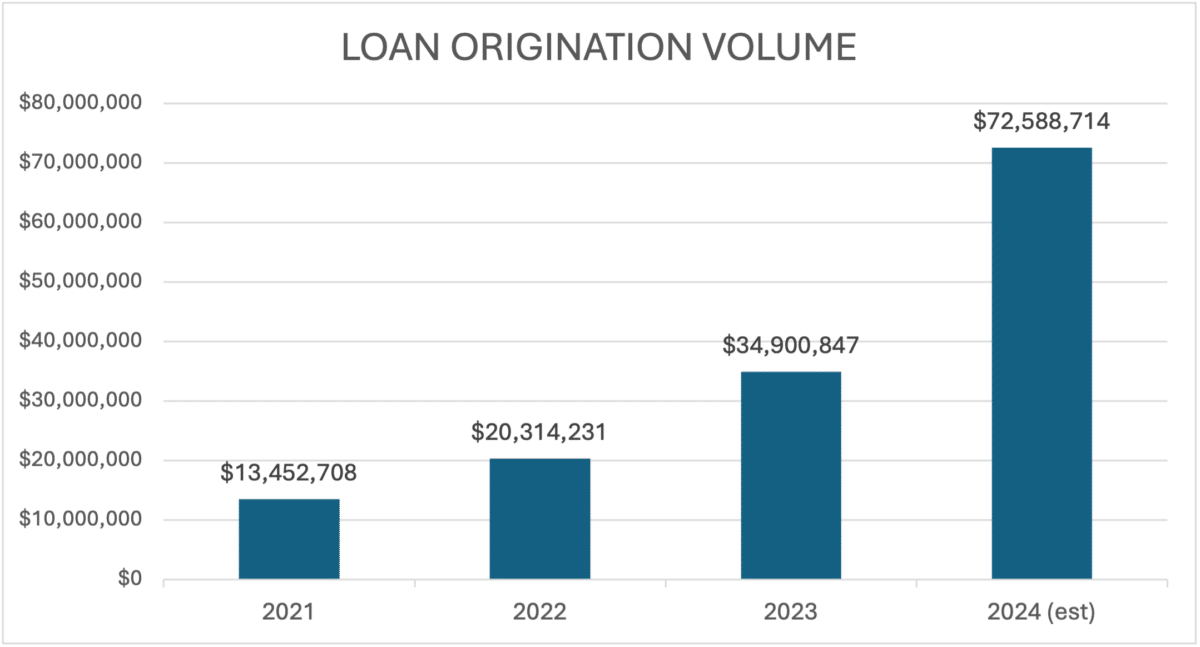

Highlighted Growth Benchmarks

The last four years of growth at The Bedrock Fund have been very exciting. We are very proud to have created a boutique lending fund for top performing real estate investors while keeping our investors’ money safe. Here are the past few years with expectations for 2024. This chart has been revised upward from $60,803,230 expected originations in 2024 to $72,588,714 for the year.

Borrower Spotlight

This month, we would like to highlight a superstar borrower/investor, Preston Saenz, from Big Water Properties in Michigan! Preston has been a HomeVestors franchisee for many years. He has been a solid borrower of The Bedrock Fund since early 2022. He is an ideal client for Bedrock because he’s so stable and steady in his business process. He typically buys 2 to 3 houses per month and has a solid rehab team who quickly gets the properties repaired and back on the market.

As an experienced investor, he has purchased over 100 homes in his career, and is building a strong rental portfolio for his family. He has been married for 20 years and has four children he hopes to have involved in the business at the right time.

Monthly Investor Statements via Onvio

At Bedrock, we pride ourselves on investor privacy and data protection. I hope that all of you are reviewing your monthly investor statements which are sent by a secure 3rd party accounting application called Onvio. We acknowledge it may not be the sexiest statement you may receive each month, and we’re working on that, but I can assure you it is highly protected, safe and secure. If you have not found this link or logged in to view your statements each month, please reach out to Britt or Jeanna at 770-368-1900 and let’s make that happen.

Referrals Welcome!

Introducing folks that you know to Bedrock could help secure your investment by spreading what small risk we have over more equity and more loans, and also help those you know to realize the same benefits you get from Bedrock. If you know anyone who might have some cash they want to invest in a predictable, safe investment, please call or email us with their info and we’ll be happy to send them some information on Bedrock. And if you’d like any updated collateral materials for yourself, just let us know.

To do so, just reach out to Mark McKeller at mark.mckeller@thebedrockfund.com; 404-317-7234,

or Tony Isbell at tony.isbell@thebedrockfund.com; 256-553-9809.